The Nigerian Exchange Ltd., NGX, has closed the week on a positive note as market capitalisation increased by N1.080 trillion, representing a 1.13 per cent gain on Friday.

The performance was driven by increased interest in top equities such as Union Dicon Salt, Austinlaz, Tantalizer, Aluminium Extrusion Industries, Champion Breweries and 29 other advancing stocks.

Specifically, the market capitalisation, which stood at N95.856 trillion at the opening, closed at N96.936 trillion.

Similarly, the All-Share Index (ASI) edged up by 1,694.33 points or 1.13 per cent, closing at 152,057.38, compared to 150,363.05 recorded on Thursday.

The uptick pushed the Year-To-Date, YTD, return to 47.73 per cent, underlining sustained investor’s confidence.

Also, the market breadth closed positive with 34 gainers and 24 losers.

Union Dicon Salt and Austinlaz led the gainers’ chart by 10 per cent each, closing at N6.60 and N2.42 per share respectively.

Tantalizer increased by 9.80 per cent, ending the session at N2.69, Aluminium Extrusion Industries grew by 9.78 per cent, settling at N12.35 while Champion Breweries rose by 9.71 per cent, closing at N16.95 per share.

On the other hand, Sovereign Trust Insurance led the losers’ chart by 7.42 per cent, finishing at N3.87 while Royal Exchange and Omatek Ventures followed by 6.84 per cent each, closing at N1.77 and N1.09 per share respectively.

Eterna dipped by 5.63 per cent, closing at N28.50 per share.

An assessment of market activity revealed a decline in market value alongside an increase in trading volume and the number of deals.

A total of 1.5 billion shares worth N21.8 billion was traded in 25,669 transactions, compared to the previous day’s 839.8 billion shares valued at N32.8 billion that was exchanged across 23,211 deals.

Neimeth recorded the highest volume and value, with 500.98 million shares traded, at N3.01 billion.

Speaking on the bullish rally, Mr Tajudeen Olayinka, Chief Executive Officer of Wyoming Capital and Partners, said the week-long surge was normal and expected.

He explained that year-end trading was typically characterised by bullish rallies, adding that there was nothing unusual driving the market to that level.

Source: NAN

READ ALSO:

UI professor, Abdulganiy Raji, is dead, to be buried today

NAF’s C-130 aircraft, crew in Accra, proceeding to Portugal

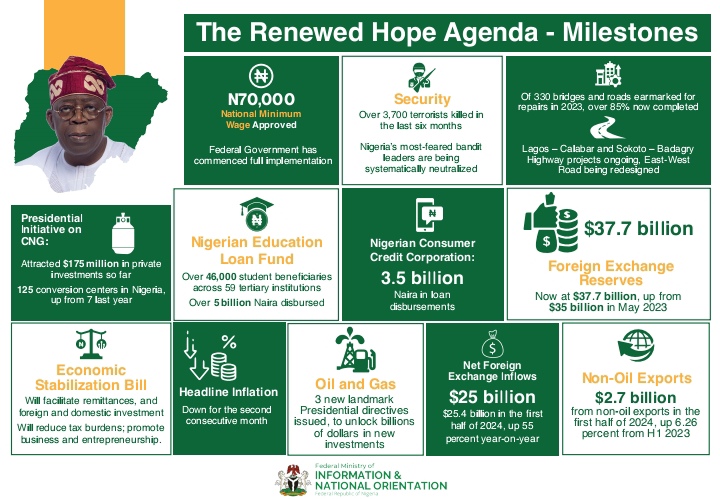

Tinubu signals ruthless crackdown on armed groups, sponsors

Tinubu leaves Abuja for Borno, Bauchi and Lagos today

FOR THE RECORD: Full text of Tinubu’s 2026 budget speech

Shell celebrates retirees at 4th annual golf tournament in Lagos

Tinubu convenes APC caucus ahead of NEC meeting

Traffic alert: Lagos issues advisory for Sunday Autofest Race

Tinubu to present 2026 budget to the National Assembly today